The Rise of Zudio: Redefining Value Fashion in India

From 80 stores to 570 in four years: How Zudio became one of the largest apparel retailer in the country and shows no signs of slowing down!

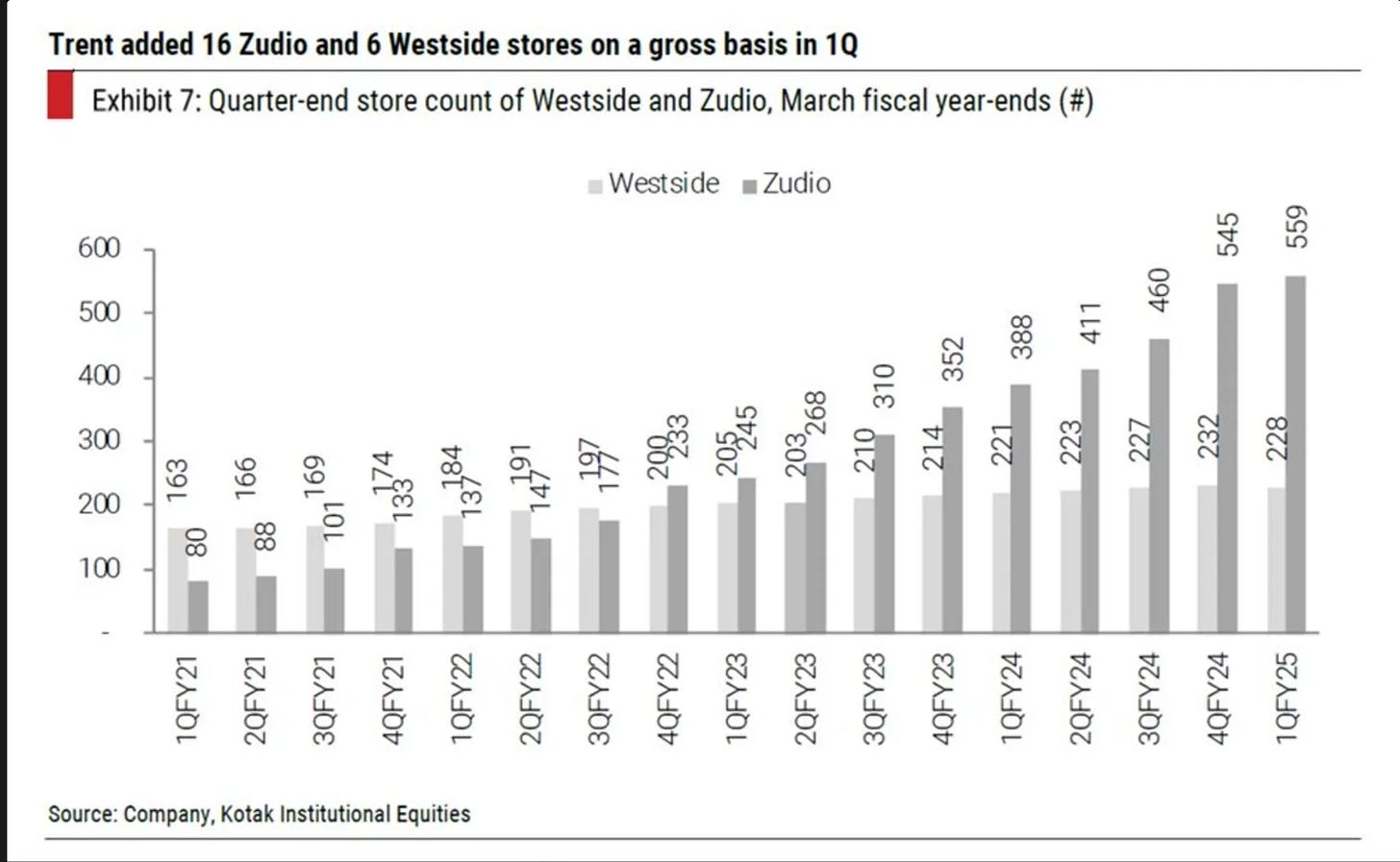

In late 2018, when Tata's retail arm Trent began expanding Zudio beyond its initial presence in Star Bazaar stores, few could have predicted its meteoric rise. Today, Zudio opens a new store every three days, has expanded from 80 stores to over 570 in just four years, and has become one of India's fastest-growing retail success stories. But numbers alone don't capture the full significance of Zudio's achievement.

While the broader retail industry has been captivated by premiumization trends and the race to capture India's affluent consumers, Zudio has been sprinting in the opposite direction, building a value apparel brand targeting the remaining 95% of the country.

While many would say it is because of providing apparel at low prices, that's just looking at Zudio in isolation. It's not like other companies haven't tried selling for lower prices before. What makes Zudio successful is a combination of multiple factors coming together:

The numbers tell a compelling story. With close to 40% standalone revenue growth (Q2 FY25) to ₹4,036 crore in recent quarters and consistent 50% plus growth rates over the past few years, Zudio has demonstrated that serving the value segment can be both profitable and scalable. Even more remarkably, it has achieved this growth while maintaining EBITDA margins of 12% – a feat particularly impressive in the notoriously challenging value retail sector.

This isn't just another retail success story; it's a case study in understanding and serving the real India.

Zudio's TG: Value-conscious buyer > Tier 2 buyer

The conventional narrative around value retail in India often gravitates toward tier-2 and tier-3 cities. However, Zudio's success reveals a more nuanced understanding of the Indian consumer. Rather than simply targeting geographical segments, Zudio identified and focused on a more fundamental characteristic: value consciousness that transcends city tiers.

In fact, contrary to popular belief, Zudio has its maximum number of stores in tier-1 cities, with outlets often located just hundreds of meters from premium shopping destinations.

What Zudio understood about their target consumer was three-fold:

These consumers are highly aware of current fashion trends, thanks to widespread social media and internet access. They follow the same Instagram influencers and fashion trends as their premium-segment counterparts.

They have a strong desire for quality and a pleasant shopping experience – they don't want to feel like they're compromising just because they're shopping on a budget.

They seek standardization and predictability in pricing, wanting to know exactly what to expect when they walk into a store.

The demographic sweet spot for Zudio lies primarily in the 16-30 age group, a segment that is fashion-conscious but often constrained by budget. These consumers represent a perfect storm of characteristics: they're digitally native, trend-aware, and value-conscious.

It's not like these customers weren't served earlier, but they were mainly buying from unorganized sellers or value retailers like DMart. They lacked access to a consistent, reliable, and enjoyable shopping experience at those price points.

The Three Core Pillars of Zudio's Success

A. Value Retail Excellence: Redefining the Value Shopping Experience

Zudio's approach to value retail represents a fundamental shift from traditional discount retailing. At its core is a sophisticated understanding that value doesn't mean cheap – it means offering the right balance of price, quality, and experience. This is executed through several key elements:

The store experience is perhaps the most visible departure from traditional value retail. Walking into a Zudio store feels remarkably similar to entering a Zara – with clean layouts, transparent glass façades, and modern store designs. This standardized, premium-feeling environment creates an aspirational shopping experience that belies the price points.

The pricing strategy is equally innovative. Rather than constant discounting – a trap many retailers fall into – Zudio maintains standardized price points (₹199, ₹299, ₹399). This transparency eliminates the need for seasonal sales and creates clear customer expectations. More importantly, it transforms the purchase decision from "Is this worth the price?" to "Which items should I get?"

B. Operational Innovation: The FOCO Model

The franchise-owned company-operated (FOCO) model has been crucial to Zudio's rapid expansion. Under this arrangement, franchisees invest in store infrastructure (typically 2-3 crores), while Trent maintains operational control. This model offers several unique advantages:

The franchisee receives a fixed percentage return (around 16%) plus profit-sharing potential, typically recovering their investment within 30-36 months. For Trent, this arrangement provides access to capital at rates potentially lower than traditional debt financing, enabling rapid expansion without straining their balance sheet.

More importantly, by maintaining operational control, Zudio ensures consistency across stores while benefiting from local market knowledge and capital. This has enabled them to maintain their rapid store opening pace – one new store every three days – while ensuring quality doesn't suffer.

C. Supply Chain Mastery: The Zara Playbook with an Indian Twist

Zudio's supply chain strategy borrows from the best practices of Zara (which is operated by Trent in India), but adapts them for the value segment. The key elements include:

A 15-day inventory turnover cycle ensures fresh fashion reaches stores quickly. This rapid turnover isn't just about fashion – it's crucial for maintaining margins in value retail. By minimizing inventory holding time and ensuring quick stock movement, Zudio reduces working capital requirements and markdown risks.

One of the most impressive aspects of Zudio's financial performance is its inventory management. The company maintains a 44-day inventory cycle, significantly better than competitors like VMart (111 days).

The 100% private label approach gives Zudio complete control over its supply chain. Unlike many retailers who mix branded and private label merchandise, Zudio's exclusive focus on private labels allows them to maintain consistent quality, control costs, and respond quickly to trends.

Perhaps most remarkably, Zudio achieves this without significant marketing spend. The store itself becomes the marketing vehicle, with word-of-mouth driving growth. In tier-2 cities, a new Zudio store opening often becomes a significant event, creating natural publicity and customer interest.

This three-pillar approach – value retail excellence, operational innovation, and supply chain mastery – has created a virtuous cycle. The FOCO model enables rapid expansion, which increases scale economies in the supply chain, allowing for better pricing, which in turn drives customer loyalty and word-of-mouth marketing.

Growth Trajectory: Decoding Zudio's Expansion Story

The raw numbers are impressive: from 80 stores in Q1FY21 to 559 stores by Q1FY25. This means Zudio added 470 stores in just 16 quarters, while its premium sibling Westside added only 148 stores in the same period. Put another way, Zudio has been opening one new store every three days – a pace that would be challenging even for deep-pocketed retailers.

But the true story lies in the revenue growth that accompanied this expansion. While many retailers struggle with same-store sales growth after rapid expansion, Zudio has maintained impressive metrics:

Year-on-year standalone revenue growth of nearly 90% in FY22

99% growth in FY23

55% growth in FY24

57% revenue growth in Q1FY25 All while maintaining a 12% EBITDA level

What makes these numbers particularly noteworthy is the context. During the same period, other major retailers showed much more modest growth: Shoppers Stop (5%), Go Fashion (16%), Page Industries (4%), and even Reliance Retail's core retail revenue grew by just 7%. Even more remarkably, Zudio achieved this growth while maintaining healthy margins, with gross margins expanding by 170 basis points year-on-year to 46.2% (FY24) with a 40% Return on capital.

The impact of this growth is visible in parent company Trent's performance. The stock has surged 1,260% over five years, with profits and sales growing at annual average rates of 57% and 36% respectively. But perhaps more tellingly, these growth rates accelerated to 100% and 53% in the most recent year, suggesting the model is actually gaining efficiency with scale rather than showing diminishing returns.

Zudio also takes advantage of the cluster-based approach, which has been proven in the past with the likes of DMart and Zara to be a much more efficient way of operating. The company's store density of 3.3 stores per city is the highest in its peer group, indicating a strategy of deep market penetration.

This expansion hasn't been random. Zudio's store rollout strategy shows clear patterns:

Clustering stores in key markets to build brand presence

Locating stores near Star Bazaar where possible to create retail synergies

Maintaining consistent store sizes and layouts to ensure operational efficiency

Targeting locations with high footfall but relatively lower rental costs

Competitive Positioning: Creating a New Retail Category

If you analyze Zudio's success, two key factors stand out: their clear understanding of their ideal customer profile (ICP) and perfect positioning. Zudio has effectively created its own category – premium value retail.

DMart: The Value Retail Contrast

The comparison with DMart is particularly instructive. While both target value-conscious consumers, their approaches are fundamentally different. DMart uses its grocery business as a customer acquisition tool, with apparel contributing 23% of its revenue.

DMart's positioning as a grocery retailer affects the perception of its apparel section. While customers might buy groceries for value, they often seek a different experience for fashion purchases.

In the case of Zudio, it has separated both categories - groceries are available at Star Bazaar, and if you want to buy clothes, you need to go to Zudio. Often, both would be present in the same location but perceived as different brands. Perhaps Trent is the actual house of brands play.

Zudio vs Other Value Retailer

Comparing it to other retailers like Reliance Retail and traditional apparel chains reveals another aspect of Zudio's competitive advantage. While these retailers often try to be everything to everyone, Zudio has maintained clear positioning:

100% private label approach vs. multi-brand retail

Consistent pricing strategy vs. variable pricing and discounting

Focused fashion offering vs. diverse category mix

Clear target audience vs. broad market approach

Perhaps the most interesting aspect of Zudio's positioning is its relationship with sister brand Westside. Trent has successfully managed to operate both brands without significant cannibalization. Westside maintains its positioning in the premium segment while Zudio caters to the value segment, creating a house of brands approach that covers different market segments effectively.

Where does it go from here

Category Expansion

Since Zudio has selected its target group so well, focusing on offline value retail, it can continue expanding categories - this is evident in its foray into beauty and jewellery. These expansions serve multiple functions:

Targeting the same value-conscious users

Addressing an underserved demand for affordable yet trendy products

Requiring no extra stores or efforts to sell

Providing higher margins, which helps in increasing the average order value

The success of these expansions is already evident:

In FY24, Zudio sold 19 fragrances and 17 lipsticks every minute

Emerging categories including beauty and personal care, innerwear, and footwear now contribute over 20% of standalone revenues.

Nail cosmetics and lipstick sales doubled and tripled respectively year-over-year

The introduction of "Pome," Zudio's lab-grown diamond brand, shows promise in the affordable jewelry segment

Keep opening new stores

Despite its rapid growth, significant geographic opportunities remain. Even today, most of the market is still very unorganized, which means many more stores can be opened in both existing and new geographies.

Market Size and Opportunity

The potential market opportunity remains substantial as the majority of the market is still unorganised even today.

Value retailers cater to 200-250 million households with a Target Addressable Market estimated at ₹56-60 trillion in 2023 and growing to ₹90-96 trillion at a CAGR of 10% in the value retail segment, where tier 2 and beyond are seeing much faster growth.

The growth ceiling is nowhere to be seen at this point.

Conclusion

The main takeaways for me when it comes to learning about Zudio:

See what is working in the West and, instead of just copying it, think carefully about how it can be applied in the Indian context.

Have a very clear ICP or TG in mind because that would enable you to make many one-way choices, which can either make or break you in the long run.

You can move fast even when you are a public company.

Observe when there is a disparity in a company’s revenue and earnings - whenever a company generates significantly less revenue from a segment but much higher earnings, it is a sign that the category can exist as a standalone company.

Two ways to make money in India: serve either 1. value-conscious buyers or 2. premium buyers; the former has less competition, much higher room for growth, but also a higher chance of failure, whereas the latter can grow very fast initially but soon enough hits a ceiling and becomes competitive.

Every great company has some elements of financial engineering; without the FOCO model, Zudio doesn’t exist, and this is a recurring theme that I have noticed in many breakout successes.

What do you think about Zudio? I would love to know your thoughts either in the comments or over email - see you next time! Bye :)